Introduction

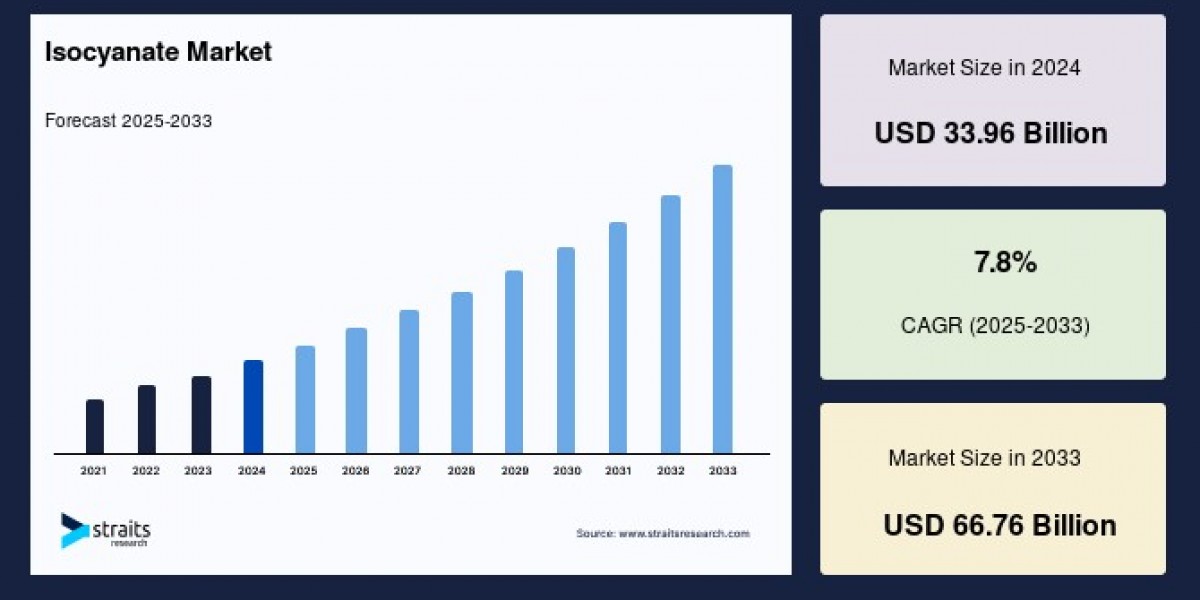

The global Isocyanate market was valued at USD 33.96 billion in 2024. It is estimated to reach USD 36.61 billion by 2025 to USD 66.76 billion by 2033, growing at a CAGR of 7.8% during the forecast period (2025–2033).

Isocyanates and Their Industrial Importance

Isocyanates are reactive chemical compounds defined by the -NCO functional group containing nitrogen, carbon, and oxygen atoms. These compounds are vital in synthesizing polyurethane polymer materials prized for flexibility, durability, and wide-ranging functionality. Polyurethanes derived from isocyanates find use in flexible and rigid foams, adhesives, sealants, coatings, elastomers, and insulation materials. Their diverse characteristics make them irreplaceable in manufacturing processes across multiple end-use industries.

Market Drivers and Industry Applications

The escalating global demand for polyurethanes is the core driver for the isocyanate market expansion. The construction sector significantly contributes to this growth, with isocyanate-based polyurethane foams used extensively for insulation in walls, roofs, and panels, enhancing energy efficiency and longevity of buildings. Rising urbanization, infrastructure developments, and a growing focus on sustainable building materials are further propelling this trend.

In the automotive industry, isocyanates are indispensable for producing lightweight, durable components such as seat foams, dashboards, coatings, and adhesives. The accelerating shift to electric vehicles and sustainability initiatives is raising the demand for advanced polyurethane materials that improve vehicle efficiency and aesthetics. Likewise, the electronics sector increasingly employs isocyanate-derived coatings and insulators for protecting sensitive components and improving thermal management.

Additional promising applications include healthcare, where isocyanates contribute to medical device adhesives and specialty materials, and renewable energy, where they help manufacture components for wind turbines and energy storage solutions. These expanding industry uses indicate the potential for isocyanates beyond traditional markets.

Regional Market Dynamics

Asia-Pacific holds the largest share in the global isocyanate market and is forecasted to grow at about 8% CAGR, driven by rapid industrialization in China, India, Japan, and Southeast Asian countries. The region’s booming construction, automotive, and electronics industries underpin this growth. North America emerges as the fastest-growing market, supported by technological advancements and stringent regulations promoting safer, more efficient polyurethane-based products.

Europe’s market growth is moderate due to stringent environmental regulations and slower progress in end-use industries. However, the focus on reducing carbon emissions and adopting eco-friendly alternatives stimulates demand for bio-based and low-emission isocyanate formulations.

Market Segmentation Insights

Product types in the market include Toluene Diisocyanate (TDI), Methylene Diphenyl Diisocyanate (MDI), monomeric MDI, and polymeric MDI. MDI accounts for the largest market share due to its widespread use in rigid polyurethane foams used in insulation. Monomeric MDI is valued for applications needing precise polymer control such as adhesives and sealants.

Application-wise, polyurethane foams dominate demand due to their extensive use in furniture, bedding, packaging, and automotive seating. Coatings, adhesives, sealants, elastomers, and electrical insulation also represent significant market segments.

Challenges and Regulatory Landscape

Despite favorable growth prospects, the isocyanate market faces regulatory and health-related challenges. Isocyanates are known to cause respiratory and skin sensitization, including occupational asthma, prompting stringent workplace safety regulations globally. Regulatory bodies like the EPA in the U.S. and the European Chemicals Agency (ECHA) have imposed exposure limits and mandatory safety training for handling isocyanates.

Growing environmental concerns have catalyzed research into bio-based isocyanates derived from renewable sources. These alternatives aim to reduce the ecological footprint of polyurethane production while meeting performance demands. Technological innovations and increasing adoption of bio-based variants are expected to create new market opportunities.

Conclusion

The isocyanate market is set for sustained growth driven by its critical role in manufacturing versatile polyurethane products spanning building insulation, automotive components, electronics, and emerging sectors like renewable energy and healthcare. Asia-Pacific leads in volume and value, supported by rapid industrial growth, while North America offers high growth potential through innovation and regulatory support.

Ongoing regulatory scrutiny related to health and environmental impacts is shaping the market landscape, encouraging advancements in safer, bio-based isocyanates. With continuous technological progress and expanding application domains, the isocyanate market is expected to nearly double its valuation by 2033, presenting substantial opportunities for industry stakeholders.