Introduction

The chlor-alkali chemical market stands as a cornerstone of the global chemical industry, vital for the production of everyday essentials from plastics to personal care products. With its diverse end-user base spanning plastics, automotive, construction, and cleaning sectors, the market’s evolution is dictated by shifts in industrial demand, technological advancement, and stringent environmental policies. As industries worldwide trend toward sustainable solutions and capacity expansion, the chlor-alkali sector is poised for consistent, value-driven growth in the years ahead.

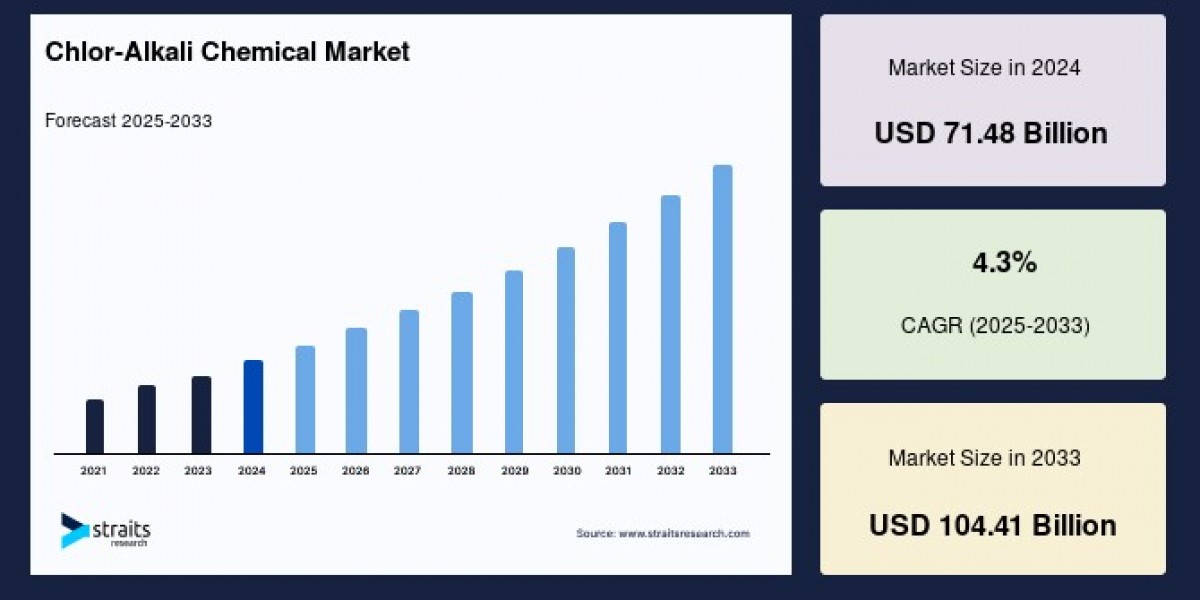

Market Overview and Growth Projections

The Chlor-alkali Chemical Market Size was valued at USD 71.48 Billion in 2024. It is projected to reach from USD 74.56 Billion by 2025 to USD 104.41 Billion by 2033, growing at a CAGR of 4.3% during the forecast period (2025–2033).

Key End-Use Applications

Construction and Plastics

Chlorine, one of the primary products, is indispensable in the manufacturing of vinyl, the precursor for polyvinyl chloride (PVC). PVC, in turn, is omnipresent in construction, automotive, and electronics owing to its versatility and durability. As nations invest heavily in infrastructure and lightweight vehicle technologies, the demand for chlorine especially for use in PVC products continues to rise. The PVC segment itself is expected to record a 4% CAGR, driven by both green building trends and energy efficiency imperatives.

Textile and Paper Industries

Caustic soda, another critical output, is central to processes in the textile, pulp and paper, and detergent industries. Expansion in global apparel and retail sectors, especially amid urbanization and income growth, is amplifying the need for caustic soda. The textile boom in Asia, particularly China’s industry bolstered by state support and strategic investments propels the region as the largest global market for chlor-alkali chemicals.

Water Treatment and Hygiene

The application of chlorine in water treatment has become even more essential, especially as governments worldwide prioritize access to safe, clean water. Chlorine’s use in disinfecting both drinking and pool waters, combined with heightened hygiene standards during and after the COVID-19 pandemic, underscores growing segmental demand. Countries like the United States, with high per capita water consumption and extensive public water management, lead in this application area. Initiatives in emerging economies to improve wastewater management such as in India further fuel chlorine consumption.

Regional Insights

Asia-Pacific: Market Leader

The Asia-Pacific region accounts for the largest market share and is expected to continue outpacing other geographies at a 3.9% CAGR. China stands as both a prolific producer and consumer of chlor-alkali chemicals, accounting for roughly half of global chemical market growth. The region’s dynamism is further accentuated by burgeoning manufacturing sectors and expansive government initiatives.

Europe: Fastest Growth Rate

Europe, predominantly led by Germany, commands the fastest growing pace, forecasted at a 2.4% CAGR. The continent’s thriving textile, pulp, and paper industries act as major demand drivers. Germany, in particular, hosts leading pulp and paper mills and remains at the forefront of textile innovation and exports.

North America: Mature Market with Consistent Demand

North America rounds out the top three regional markets. The U.S. chemical industry’s deep roots and substantial installed capacity characterized by sustained new investments and technological upgrades ensure a steady demand for chlor-alkali chemicals.

Technology and Process Trends

The membrane cell process has emerged as the preferred production technology, given its energy efficiency and high product purity. The global shift away from mercury-based production processes, especially in Europe, further cements this trend. Diaphragm cell production, known for low energy requirements, continues to serve as a significant contributor, especially where process economics and existing infrastructure dictate adoption.

Product Segment Analysis

Chlorine: The segment holds the largest market share and grows at a 3.7% CAGR. Beyond its role in water disinfection, chlorine is critical in organic synthesis and pharmaceutical manufacturing, with over 85% of medications utilizing chlorine or its derivatives during production. The pandemic era has only heightened the need for chlorine in water treatment and sanitization.

Caustic Soda: Serving as an inexpensive, universally used alkali, caustic soda’s demand trajectory aligns closely with growth in the aluminum, chemical, textile, and detergent sectors. The increasing adoption of aluminum in automotive manufacturing considering lightweighting imperatives drives additional volume growth.

Soda Ash: Predominantly used in glass-making, detergents, and chemical synthesis, soda ash faces heightened demand with the surge in construction and cleaning product manufacturing. Its role as a component in detergents and water treatment chemicals ensures steady, long-term growth.

Opportunities and Challenges

Sustainability and Environmental Pressures

A key challenge facing the sector is the energy-intensive nature of chlor-alkali production, especially amid intensifying government regulations targeting carbon emissions and environmental impact. The adoption of mercury-free membrane cell technology and compliance with stricter emissions guidelines such as those mandated in India reflects industry-wide commitment to sustainability. Policymakers and industry leaders are working collaboratively to promote an energy policy that prioritizes reliability, environmental responsibility, and innovation.

Expanding Scope: Soaps, Detergents, and Hygiene

The rapidly growing soaps and detergents segment highlights new avenues for market expansion. Personal hygiene awareness and global health events, including the COVID-19 pandemic, have catalyzed demand for caustic soda and chlorine-based products. European imports of soaps and hygiene products have soared, reinforcing steady consumption even in mature markets.

Conclusion

The chlor-alkali chemical market is entering an era marked by steady expansion, driven by infrastructure development, sustainability mandates, and escalating demand across water treatment, hygiene, and key industrial sectors. Advances in production technology and increasing alignment with environmental regulations position market leaders to capture new growth opportunities. As global industries confront growing demand and sustainability targets, the chlor-alkali sector remains an indispensable supplier of essential building-block chemicals and materials for a rapidly evolving world.