Introduction

Polyethylene naphthalate (PEN) is firmly establishing itself as a high-performance polyester with superior thermal stability, mechanical strength, and barrier properties compared to traditional polyethylene terephthalate (PET). Its versatility drives adoption across packaging, electronics, automotive, and medical applications, with evolving consumer and regulatory demands accelerating market growth.

Market Overview and Growth Drivers

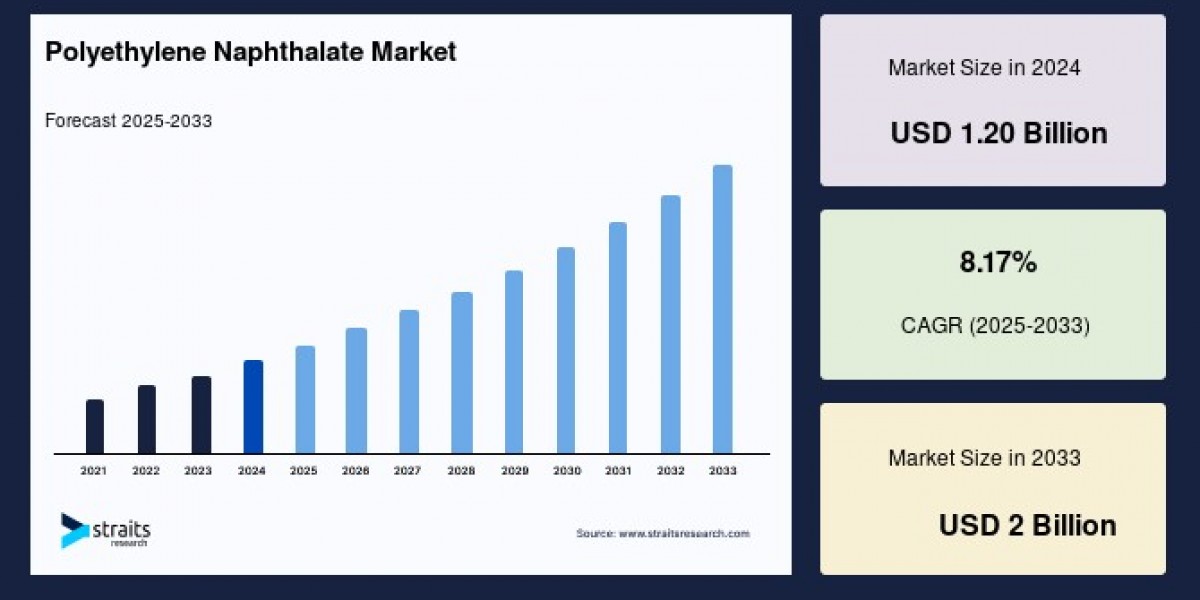

The global polyethylene naphthalate market size was valued at USD 1.20 billion in 2024 and is projected to reach from USD 1.27 billion in 2025 to USD 2 billion by 2033, growing at a CAGR of 8.17% during the forecast period (2025-2033). The growth of the market is attributed to the rising demand in beverage bottling.

The beverage industry’s transition to eco-friendly packaging is a key growth catalyst. PEN extends shelf life and preserves beverage quality owing to its excellent barrier characteristics, particularly its resistance to oxygen and carbon dioxide ingress.

In electronics, the need for substrates with high temperature tolerance and dimensional stability drives the use of PEN films in flexible printed circuits, display panels, and battery separators.

Key Applications and Advancements

The beverage packaging segment continues to dominate PEN consumption, experiencing a 31% year-on-year growth in 2024. Leading beverage brands are incorporating PEN for specialty and premium product lines, taking advantage of the material’s ability to withstand high sterilization temperatures for hot-filled teas and dairy beverages.

Electronics represents another dynamic application field, with ongoing research focused on yielding PEN films with even higher temperature resistance and improved surface properties. Companies are also making strides in developing bio-based and recycled PEN variants, optimizing both cost and sustainability.

Market Constraints and Industry Response

Despite its advantages, PEN’s wider market adoption is curtailed by:

Higher production costs due to complex polymerization methods and pricier raw materials, making PEN less competitive in price-sensitive markets.

Limited recycling infrastructure compared to PET, leading to additional end-of-life management costs.

Industry leaders are responding by investing in process optimization and pilot programs for cost-reduced, recycled, and bio-based PEN. Such initiatives are expected to enhance PEN’s competitive positioning over the next decade.

Regional Analysis

Asia Pacific: Market Leader

Asia Pacific commands over 60% of global PEN revenue, fueled by its robust manufacturing sector and burgeoning electronics and packaged-food industries. China is at the forefront, leveraging PEN for electronics, OLED displays, and premium beverage packaging, while India’s market is set to grow rapidly amid urbanization and regulatory pushes for sustainable packaging.

North America: Fastest Growing

North America boasts the fastest growth trajectory, spurred by demand across packaging, electronics, and automotive industries. Regulatory incentives and a strong sustainability agenda further drive adoption of PEN-based solutions, notably hybrid PET/PEN bottles and advanced electronic films.

Europe: Sustainability at the Core

Europe’s PEN market is shaped by stringent packaging and sustainability regulations. Leading economies like Germany and the UK are integrating PEN into multilayer food packaging, automotive insulation, and electronic components in response to government eco-initiatives and EPR mandates.

Emerging Markets and Growth Hotspots

Emerging economies in Latin America and Southeast Asia are experiencing rapid PEN adoption, supported by industrial growth and evolving environmental frameworks. Regional players cultivate alliances and invest in distribution networks to tap into these opportunities.

Competitive Landscape

The PEN marketplace is marked by intense competition and innovation-focused product strategies:

Teijin Limited holds a dominant market share (about 66%), emphasizing R&D and global partnerships.

Other major companies include SKC, Toray Advanced Materials, Kolon Plastics, and local leaders responsive to regional customer needs.

Firms compete on differentiation, cost reduction, and sustainability, with joint ventures and collaborations targeting new product lines and recycling initiatives.

Conclusion

Polyethylene naphthalate’s trajectory reflects a pivotal moment in materials science, shaped by rising demand for high-performance, sustainable solutions. Regulatory shifts, consumer preferences, and continuous advancements in recycling and bio-based technologies suggest PEN will remain a cornerstone of the evolving global packaging, electronics, and automotive industries.