Introduction

The dietary supplements market has emerged as a pivotal sector within the global health and wellness industry, driven by heightened consumer awareness, innovation in formulation, and easy access through online retailing. This article explores the key dynamics shaping the dietary supplements market, the influence of regulatory environments, regional trends, and segment-wise insights that define the sector’s expansion into the next decade.

Market Overview and Growth Dynamics

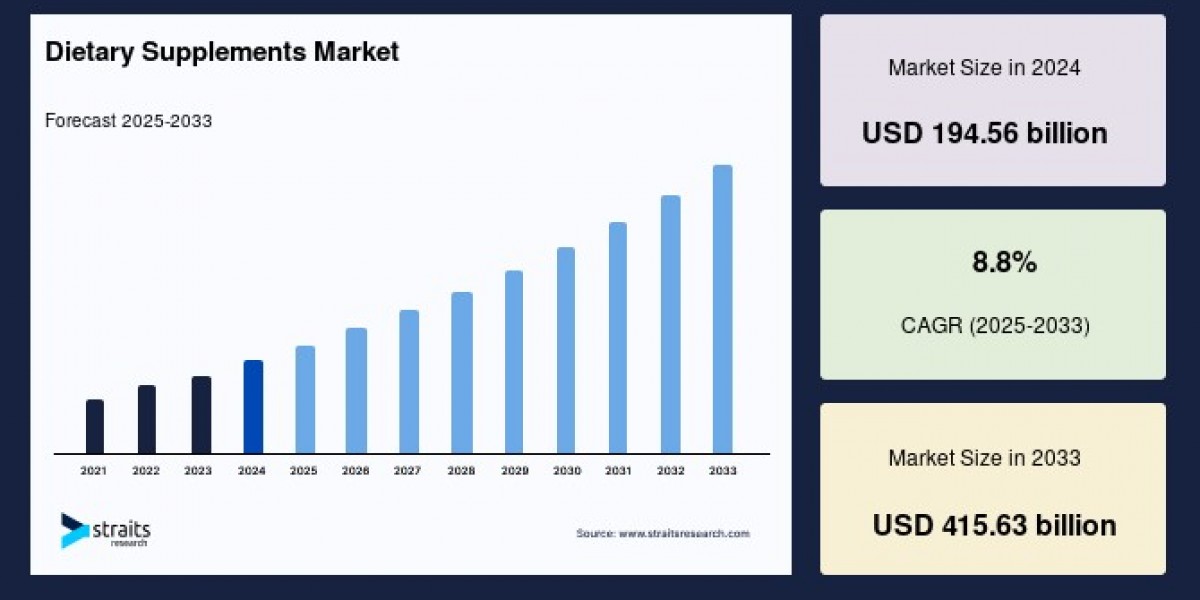

The global dietary supplements market size was valued at USD 194.56 billion in 2024 and is projected to reach from USD 211.68 billion in 2025 to USD 415.63 billion by 2033, growing at a CAGR of 8.80% during the forecast period (2025-2033).

Dietary supplements encompass vitamins, minerals, amino acids, botanical extracts, and other nutrients available through culinary, synthetic, animal, and plant sources. They are designed to fill nutritional gaps and supplement regular diets, typically consumed in pills, capsules, powders, or liquids.

Key Market Drivers

Rising Preventive Healthcare Trends: The COVID-19 pandemic accelerated the adoption of proactive wellness strategies globally. Consumers began prioritizing immune health, leading to increased demand for supplements such as vitamin C, zinc, and elderberry.

E-commerce Expansion: Online retailing has made dietary supplements accessible to broader consumer demographics, contributing significantly to market proliferation.

Product Innovation: Manufacturers have introduced sophisticated delivery formats, personalized blends, and plant-based or vegan supplements to cater to evolving consumer preferences. The rise of nutrigenomics—linking genetic profiles to nutrition—now drives personalized supplement regimens.

Regulatory Landscape

Stringent regulatory frameworks across key geographies ensure product safety, quality, and accurate labeling. In the United States, the FDA governs the dietary supplement market under the Dietary Supplement Health and Education Act (DSHEA), requiring manufacturers to follow Good Manufacturing Practices (GMPs). The European Union’s Food Supplements Directive provides parallel oversight, with specific standards for allowable ingredients and labeling. Regulatory rigor boosts consumer trust and safety, but also presents barriers to entry for new players.

Regional Insights

North America: North America remains the largest market, propelled by high health awareness and a strong wellness culture. The incidence of supplement use continues to climb, with about 80% of American adults reporting intake in 2024. The robust regulatory environment and integration of supplements in mainstream retail further fuel the region’s leadership.

Asia-Pacific: The Asia-Pacific region is the fastest-growing market, with a CAGR of 8.9%. Rising disposable incomes, demographic shifts, and a blend of traditional herbal medicine with modern nutraceutical practices drive market growth. Highly populated countries like China, India, and Japan are at the forefront, with increased approval for new supplement products and higher consumer adoption.

Europe and Other Regions: Europe enforces rigorous standards, contributing to a mature market focused on quality and efficacy. In emerging regions, greater spending power and awareness campaigns are boosting supplement consumption.

Market Segmentation

By Form: Soft gels and pills are the dominant form, preferred for convenience, stability, and palatability. Powders and liquids, while growing, remain secondary due to usability factors.

By Application: Weight loss supplements command the largest market share, reflecting a broader societal focus on fitness and healthy living. Supplements targeting specific concerns such as immunity, bone health, and hormonal balance are also growing in popularity.

By Ingredient: Vitamins and minerals lead the ingredient segmentation, closely followed by amino acids and botanical supplements. Increasing consumer education has cemented their pivotal role in wellness routines.

By Demographic: Women’s nutritional needs have become a focal point, with specialized products for prenatal care, menopause, and bone health. Supplement makers target this demographic with unique formulations and marketing efforts.

By Distribution Channel: Pharmacies and drugstores dominate, benefiting from consumer trust, regulatory oversight, and access to expert guidance. Nonetheless, e-commerce continues to gain traction and gradually shift buying patterns.

Emerging Trends and Opportunities

Personalized nutrition and technology-driven product customization are transforming consumer expectations. Companies leverage advances in nutrigenomics and big data analytics to develop individualized vitamin packs. The popularity of plant-based and organic ingredients reflects a wider trend toward sustainable and ethical consumption.

Moreover, innovative marketing, including endorsement by wellness influencers and targeted product lines for niche health concerns, continues to shape competitive positioning. As companies refine their approaches, brand loyalty and consumer satisfaction will underpin long-term growth.

Challenges and Future Outlook

Strict regulatory frameworks, transparency requirements, and quality control standards represent ongoing challenges for industry stakeholders. However, the sector’s growth potential remains robust, as populations age, chronic disease prevalence rises, and proactive health management becomes mainstream.

Looking ahead, the dietary supplements market is poised for transformative growth, underpinned by continuous innovation, expanding regional adoption, and a shift toward highly personalized health solutions.