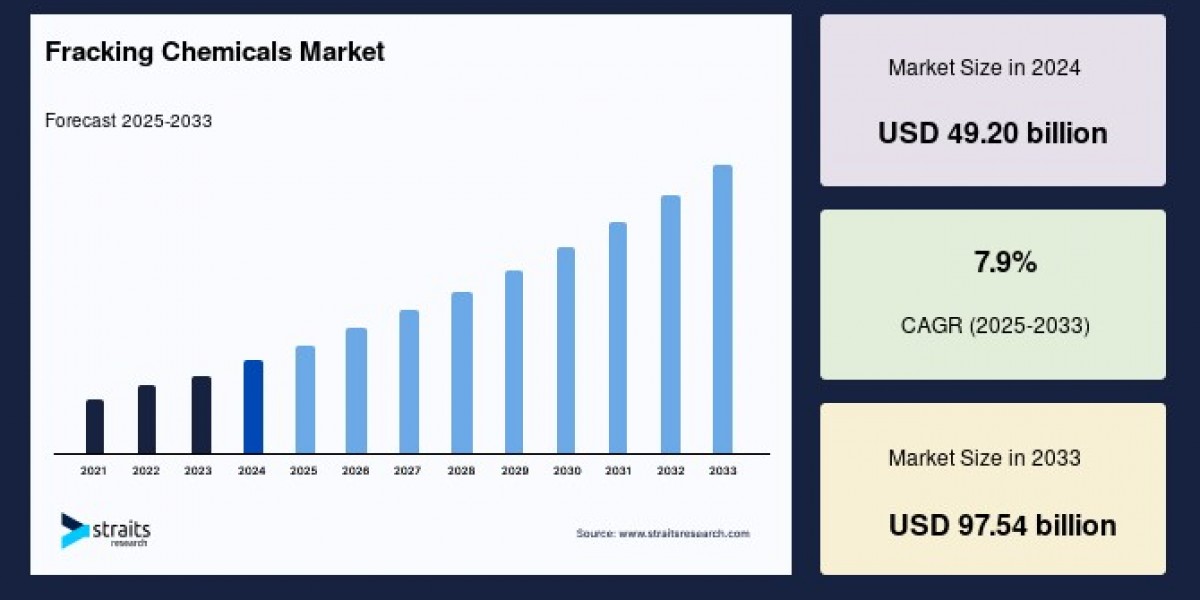

The global fracking chemicals market size was valued at USD 49.20 billion in 2024 and is projected to reach from USD 53.09 billion in 2025 to USD 97.54 billion by 2033, growing at a CAGR of 7.9% during the forecast period (2025-2033). The increase in market share during the forecast period is related to the use of alternative fracking technologies, such as waterless fracking, and the usage of green chemicals, propane gel, and other technologies is expected to create substantial growth opportunities in the future.

Understanding Fracking Chemicals and Their Role

Fracking chemicals, also known as fracturing fluids, are complex blends of substances used in hydraulic fracturing to enhance the extraction of hydrocarbons from underground reservoirs. They serve multiple purposes, including protecting the well from corrosion, lubricating the extraction process, preventing blockages, and inhibiting bacterial growth. Typical components include carrier or base fluids, biocides, scale inhibitors, solvents, friction reducers, corrosion inhibitors, surfactants, and various additives tailored to specific reservoir conditions.

Although these chemicals only comprise about 1% of the fracking fluid volume, the quantities involved in each operation are substantial—often tens of thousands of gallons—reflecting the scale of hydraulic fracturing jobs. The exact formulation varies by company and operation, sometimes kept proprietary, but each chemical plays a critical role in maintaining operational efficiency and well integrity.

Market Drivers: Energy Demand and Technological Innovation

The main driver behind the fracking chemicals market is the growing global demand for oil and natural gas, essential for powering industrial, residential, and transportation sectors. As conventional hydrocarbon sources become less abundant, reliance on unconventional reserves accessed through hydraulic fracturing increases. This shift has made fracking chemicals indispensable for unlocking previously inaccessible resources.

Technological improvements also propel market growth. Companies invest heavily in research and development to innovate in chemical formulations that enhance fracturing efficiency while reducing environmental impact. Emerging technologies include waterless fracking methods using propane gel and green chemical solutions that promise greater sustainability. Advances in nanotechnology and polymer chemistry have enabled the design of customized chemicals suited for diverse geological settings, allowing operators to optimize extraction and minimize formation damage.

Environmental and Regulatory Challenges

Despite growth opportunities, environmental concerns pose significant challenges. Hydraulic fracturing involves injecting large volumes of water mixed with chemicals deep underground, causing potential risks such as groundwater contamination, air pollution, and induced seismicity. Public apprehension regarding these impacts has led to increased regulatory oversight in some regions. Regulations may impose restrictions on chemical disclosure, usage, storage, and disposal, creating compliance costs and operational complexity.

Fracking chemical suppliers must adapt to these evolving standards by developing environmentally friendly formulations and participating in transparent disclosure initiatives. The industry is trending towards safer, biodegradable chemicals and recycled water usage to mitigate ecological footprint, which also opens new market niches.

Product Segments and Fluid Types

The fracking chemicals market is segmented by product function and fluid type. Key functional categories include gelling agents, friction reducers, corrosion inhibitors, biocides, surfactants, and scale inhibitors. Gelling agents, such as guar gum and its derivatives, dominate as they increase fluid viscosity critical for proppant suspension and transport deep into fractures. Friction reducers improve pumping efficiency, and corrosion inhibitors protect costly equipment.

Regarding fluid types, water-based fluids lead the market due to their cost-effectiveness, ease of handling, and better environmental profile. Oil-based fluids are used in specific applications requiring thermal stability or enhanced lubrication, but come with higher costs and disposal challenges. Foam-based fluids are a niche but growing segment for environmentally sensitive areas due to reduced water consumption.

Regional Market Dynamics

North America holds the largest share of the global fracking chemicals market, driven by extensive shale gas and tight oil operations. The United States and Canada have vast unconventional resources and advanced infrastructure supporting large-scale hydraulic fracturing. Regulatory support, technological leadership, and high adoption of recycled water and nano-enhanced fluids also bolster the region’s dominance.

Asia-Pacific is the fastest-growing market, with significant shale exploration in countries like China, India, and Southeast Asia. Industrialization and rising energy needs in this region stimulate demand for fracking chemicals despite challenges related to geological conditions and diverse regulatory environments. Efforts to increase indigenous energy production through shale development make the Asia-Pacific a key emerging market.

Outlook and Opportunities

The future of the fracking chemicals market looks robust amid increasing global energy demands and continued expansion of unconventional hydrocarbon production. Opportunities lie in developing greener, more efficient chemical packages, adoption of waterless fracking technologies, and leveraging digital tools for real-time reservoir monitoring. Companies able to balance performance with environmental stewardship will gain competitive advantages.

Furthermore, growing unconventional oil and gas projects in regions like the Middle East, Latin America, and Africa offer additional growth avenues. Strategic partnerships, innovation, and adherence to evolving regulations will be critical for market players aiming to capitalize on these prospects.

In summary, the fracking chemicals market is a vital and dynamic segment of the hydrocarbon extraction industry, combining cutting-edge science, expanding energy needs, and environmental considerations to shape its trajectory for the coming decade.