Introduction

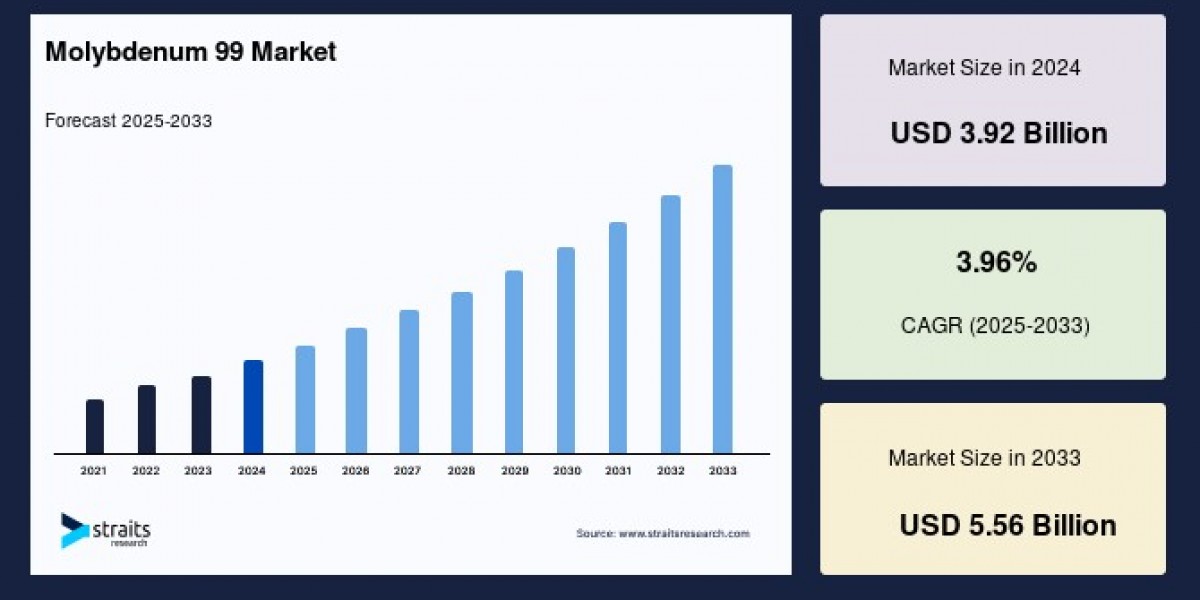

The global molybdenum 99 market size was valued at USD 3.92 billion in 2024 and is projected to grow from USD 4.07 billion in 2025 to USD 5.56 billion by 2033, growing at a CAGR of 3.96% during the forecast period (2025-2033). The growth of the market is attributed to the increasing prevalence of chronic diseases.

Market Drivers

The escalating prevalence of chronic diseases such as cancer and cardiovascular conditions is a primary growth driver for the molybdenum-99 market. Early and accurate diagnosis facilitated by imaging technologies using Mo-99-derived Tc-99m improves treatment outcomes and patient management. The aging global population further intensifies this demand as chronic disease incidence rises with age.

Technological advancements in radiopharmaceuticals are spearheading market expansion by enhancing production efficiency and isotope functionality. Innovations such as cyclotron and linear accelerator-based production methods reduce reliance on traditional uranium reactors, address supply chain vulnerabilities, and offer sustainable alternatives to highly enriched uranium (HEU) use.

Market Segmentation

By Production Method: The market is dominated by production using highly enriched uranium (HEU) due to its high Mo-99 yield. However, concerns regarding nuclear proliferation have prompted a gradual shift toward low-enriched uranium (LEU) or non-HEU methods, despite their typically lower efficiency and higher costs. Emerging production technologies focusing on accelerator-based methods continue to gain traction for their safety and supply reliability advantages.

By Application: The medical segment overwhelmingly dominates the market, driven primarily by nuclear medicine applications such as Single Photon Emission Computed Tomography (SPECT). SPECT utilizes Tc-99m emissions to produce detailed 3D images facilitating the diagnosis of cancers, bone disorders, and cardiovascular diseases. Research institutes also constitute a significant application area, leveraging Mo-99 for developing new diagnostic and therapeutic radiopharmaceuticals.

Geographic Insights

North America holds the largest share of the global Mo-99 market, attributed to advanced healthcare infrastructure, high healthcare spending, and a robust network of diagnostic facilities. The United States leads consumption due to the high prevalence of chronic diseases and significant investments in research and isotope production innovations, particularly non-uranium-based methods pioneered by key companies.

Europe is the fastest-growing region, supported by established nuclear medicine facilities and government initiatives promoting the development of non-HEU Mo-99 production technologies. Countries such as the Netherlands, Belgium, and France are prominent producers and suppliers. The aging population and high demand for advanced diagnostic imaging further underpin growth in this region.

The Asia-Pacific region is emerging as a promising market due to increasing healthcare expenditure, rising health awareness, and the expansion of nuclear medicine infrastructure in countries like Japan, South Korea, and China. Governmental efforts to establish domestic supply chains and invest in production modernization contribute to regional growth potential.

Supply Chain and Production Challenges

Mo-99’s relatively short half-life, approximately 66 hours, presents significant challenges in production, storage, and distribution. The supply chain is sensitive to disruptions, with production facilities concentrated in a limited number of reactors worldwide. Historical outages, such as the shutdown of the National Research Universal reactor in Canada in 2018, have resulted in global shortages impacting patient care.

Transitioning from HEU to LEU or alternative production methods is complicated by the need to balance security concerns with production efficiency. Efforts to diversify production sources, implement accelerator-based technologies, and improve logistical coordination are essential to ensuring a stable Mo-99 supply.

Technological Innovations

Growing demand and supply challenges have accelerated the adoption of novel technologies. Cyclotron and linear accelerator approaches enable Mo-99 production without relying on uranium targets, enhancing safety and regulatory compliance. Automation and remote control in production facilities are improving efficiency and reducing human exposure risks.

Advanced radiopharmaceutical development enhances the performance of Mo-99-based diagnostics, leading to better image quality and more precise medical interventions. Research collaborations between industry, healthcare providers, and government entities are fostering innovation and investment in sustainable Mo-99 production methods.

Future Outlook

The molybdenum-99 market is set for steady growth, driven by the increasing global burden of chronic diseases and expanding capabilities in nuclear medicine diagnostics. Continued innovation in production techniques and supply chain management will be vital to overcoming current vulnerabilities. Regions with strong healthcare infrastructure and supportive policies, such as North America and Europe, will lead market growth, while emerging economies in the Asia-Pacific present significant opportunities.

As technetium-99m remains indispensable for advanced imaging applications, the demand for Mo-99 will persist, necessitating strategic investments in research, production diversity, and regulatory frameworks to secure reliable, efficient, and safe supply chains.

Conclusion

Molybdenum-99 is a critical isotope underpinning global nuclear medicine diagnostics, with broad applications in disease detection and medical research. Market growth is propelled by rising chronic disease prevalence, aging populations, and continuous technological progress in isotope production and radiopharmaceuticals. Addressing supply challenges through innovative technologies and diversified production methods will be crucial for the future stability and expansion of the Mo-99 market worldwide.

![VPN in Serbia – Top Picks & Features [2024 Guide]](https://www.talkanet.com/upload/photos/2025/09/KTXfUbAnlcdnI4mIl2Vx_10_8044f9633a098c73f90d09f78bd5ef8c_image.png)