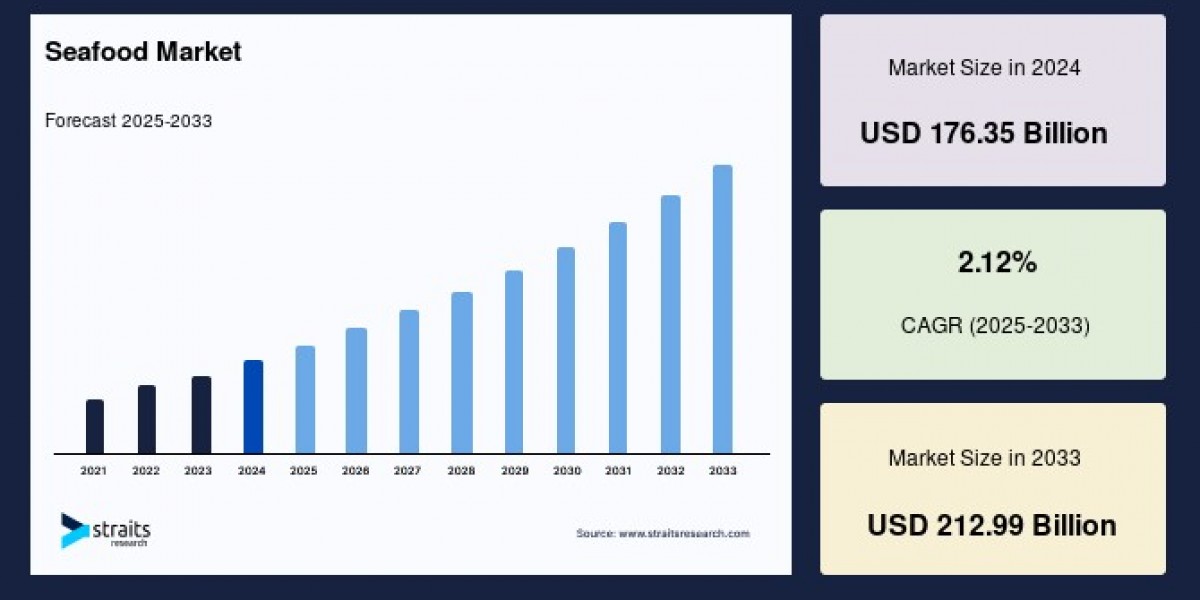

The global seafood market size was valued at USD 176.35 billion in 2024 and is estimated to reach from USD 180.08 billion in 2025 to USD 212.99 billion by 2033, growing at a CAGR of 2.12% during the forecast period (2025–2033).

Rising Demand Fueled by Health Awareness and Lifestyle Changes

Consumers worldwide are increasingly gravitating toward pescetarianism, a diet incorporating seafood but excluding typical meats such as beef, pork, and poultry. This shift is largely motivated by the growing health consciousness surrounding seafood, as it is rich in essential proteins, omega-3 fatty acids, vitamins, and minerals that support cardiovascular health and reduce obesity risks. Additionally, concerns over the negative health and ethical aspects of meat consumption, such as high cholesterol levels, cancer risks, and questionable cattle farming practices, have further bolstered seafood’s appeal as a sustainable and nutritious protein alternative.

The expansion of fast-food outlets and increased eating-out trends, especially in urban areas, are also amplifying seafood consumption. Collaborations between manufacturers and foodservice providers enhance availability and variety, making seafood more accessible and attractive to modern consumers.

Regional Market Insights: Asia-Pacific Leads, Europe and North America Follow

Asia-Pacific stands as the dominant region in the global seafood market, holding the largest share and expected to register a CAGR of 2.2% during the forecast period. This region's growth stems from increasing disposable incomes, a surge in seafood dining options, and robust government investments in aquaculture infrastructure. For example, China’s significant advances in fish and shrimp farming, including large offshore aquaculture platforms, highlight the region’s emphasis on scaling production to meet demand.

Despite some supply challenges, such as shrimp shortages due to disease outbreaks like Early Mortality Syndrome affecting several Southeast Asian countries, the Asia-Pacific continues to feature robust growth opportunities driven by both domestic consumption and export expansion.

North America remains a mature market with a well-established supply chain and health-conscious consumer base. States such as Alaska, California, and Washington lead wild-caught seafood harvesting. Here, seafood’s health benefits reduced heart disease risk, and better weight management drive growing popularity, supported by increased inclusion of fish-based fast food options and premium products.

Europe’s seafood market is characterized by steady growth, boosted by high per capita seafood consumption in countries like Spain and Italy. The region’s expanding consumer awareness of seafood benefits and preference for premium fish species supports ongoing market development.

Product Segmentation: Fish and Mollusks Dominate

The fish segment dominates the seafood market, predicted to grow at a CAGR of 2.2%. Large fish species such as sharks, skates, rays, and sturgeons are considered safe and healthy for consumption. These fish are sourced from oceans, rivers, lakes, and aquaculture farms worldwide before reaching consumers.

Mollusks, including oysters, scallops, clams, and mussels, also hold a significant market share due to their economic value and versatility. Leading exporters such as Peru, Japan, and Canada, alongside major importers like China, fuel the mollusk market. Newly developed products, such as triploid oyster seed, enhance availability and meet escalating demand for high-value mollusk products.

Distribution Channels: Retail and Institutional Growth

The retail sector owns the largest market share among distribution channels, expanding at about 1.8% CAGR. Improvements in supply chain infrastructure, rising affordability, and the convenience of physical and online retail platforms contribute to retail’s strong position. Large retail stores offering one-stop seafood solutions with competitive pricing drive consumer adoption.

The institutional segment, including office canteens, research institutes, and foodservice providers, also supports market growth by routinely supplying seafood as a protein source to a broad population base. The rise in office count and research facilities further fuels demand in this segment.

Challenges and Sustainability Efforts

Despite the growth outlook, the seafood market faces sustainability challenges. Overexploitation of wild fish stocks, where more than 90% of fish stocks are overfished along with environmental degradation from industrial waste dumping, threatens long-term supply. Endangered species such as angel sharks and salmon emphasize the need for responsible consumption.

To address these challenges, stakeholders including fishermen, processors, retailers, restaurants, and advocacy group,s are increasingly collaborating to promote sustainable fishing and aquaculture. Seafood establishments, particularly in the U.S. and Scotland, focus on offering sustainable seafood options like catfish and tilapia to consumers.

International treaties and regulations aim to manage fishing limits, while aquaculture expansion provides an alternative supply source to meet growing demand without further compromising wild populations.