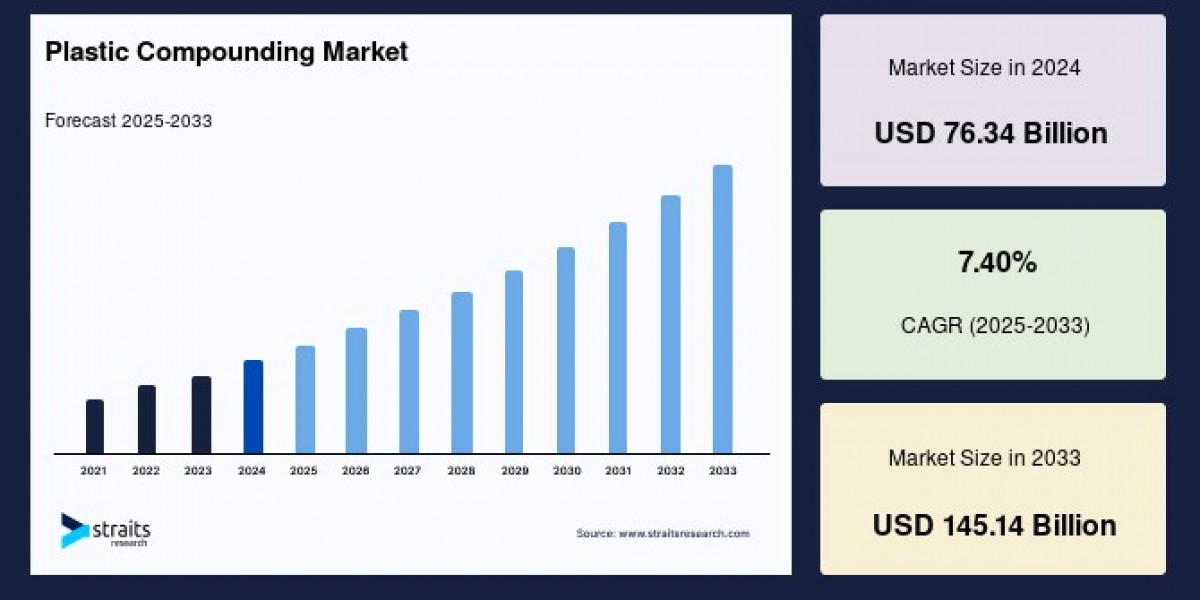

The global plastic compounding market size was valued at USD 76.34 billion in 2024 and is projected to reach from USD 81.99 billion in 2025 to USD 145.14 billion by 2033, growing at a CAGR of 7.40% during the forecast period (2025-2033).

Understanding Plastic Compounding

Plastic compounding involves the process of mixing polymers with various additives to produce customized plastics with enhanced properties tailored to specific industry requirements. Through compounding, plastics can have improved strength, stiffness, flame retardance, electrical conductivity, and thermal stability. Natural fibers such as cotton, hemp, and flax are often blended into thermoplastic or thermosetting polymer matrices to increase composite strength. Additives like plasticizers, antioxidants, flame retardants, and conductive fibers further enhance performance, enabling plastic parts to replace heavier or less durable traditional materials like metals or wood in many applications.

Key Drivers Shaping Market Growth

One of the primary growth drivers for plastic compounding is the rising demand within the automotive industry for lightweight yet durable materials. Plastic compounds help reduce vehicle weight, improving fuel efficiency and lowering carbon emissions, which are crucial factors amid tightening environmental regulations and growing consumer awareness about sustainability. The adoption of electric vehicles is also fueling demand for advanced compounded plastics that can meet evolving performance criteria.

The construction sector represents another major application area, leveraging compounded plastics for insulation, piping, windows, doors, and flooring materials. The ability of compounded plastics to offer strength comparable to steel, resistance to rust, and customizable aesthetics makes them preferred materials for commercial and residential buildings. Increasing infrastructure projects and consumer focus on energy-efficient, attractive interiors support expansion in this segment.

Technological Advancements and Sustainability

Advances in thermoplastic compounding have expanded applications into healthcare, consumer goods, and emerging fields like three-dimensional (3D) modeling. Industry players are enhancing capacities for producing long-fiber-reinforced thermoplastics and developing environmentally friendly bio-based compounds. Leading companies invest significantly in research and development to improve the compatibility, performance, and sustainability of bio-plastics, responding to consumer demand for eco-friendly materials with a lower carbon footprint.

Sustainability trends are particularly influential in automotive compounding, where manufacturers strive to develop novel sustainable materials without compromising mechanical properties. These innovations support global efforts to reduce emissions and promote circular economy principles.

Regional Market Insights

Asia-Pacific dominates the plastic compounding market, holding the largest share and expected to grow at a CAGR of 6.11%. The region benefits from rapid industrialization, a robust manufacturing base, and leading producers and consumers of automobiles, electrical and electronic goods, packaging, and consumer products. China, India, Japan, and Australia notably contribute to regional expansion. The growth is also driven by rising demand in automotive, industrial machinery, construction, and packaging sectors.

North America is another significant market, forecasted to grow at a CAGR of 6.85%. Infrastructure development, government support for housing recovery, and reconstruction efforts in the United States, Canada, and Mexico are boosting demand for compounded plastics. Although the market faced challenges due to fluctuating COVID-19 cases and cross-border trade restrictions, ongoing domestic and international reconstruction activities are expected to encourage market growth during the forecast period.

Trends by Plastic Type and End-Use Segment

Polypropylene (PP) stands out as the highest contributor by plastic type, growing at a CAGR of 6.18%. Its high impact resistance, chemical and temperature stability, and fatigue resistance make it extensively used in automotive parts, where lightweight and durability are essential. The expanding automotive production and sales across Latin America and Asia further propel demand for PP compounds.

Bio-based plastics are experiencing robust growth at a CAGR of 6.71%. High-performance bio-plastic grades introduced by key players promote the use of sustainable polymers. Additives designed specifically for biopolymers enhance processability and functionality, helping manufacturers meet stringent environmental standards and consumer expectations.

The automotive segment remains the leading end-use market, with a CAGR of 6.43%. Plastic compounding enables automakers to replace heavier metals with reinforced plastics like PVC, ABS, polyamide, and polystyrene, reducing vehicle weight and environmental impact. The sector’s dynamic evolution with the rise of electric vehicles is expected to sustain steady demand for innovative compounded plastics.

Market Challenges and Outlook

Despite the promising growth trajectory, the plastic compounding market faces challenges. The fluctuating prices of crude oil, which is a key feedstock for resin production, introduce cost uncertainties affecting raw material availability. Additionally, the high capital investment involved in designing and producing injection molding tools, critical for final plastic product manufacturing, restricts some market players.

The demand for plastics that meet strict environmental and safety regulations necessitates further innovation in raw materials and compounding methods. However, these challenges also open opportunities for companies investing in sustainable, bio-based, and high-performance plastics that can deliver value while aligning with global ecological goals.

Conclusion

The plastic compounding market is positioned for strong growth fueled by increasing demand across automotive, construction, and consumer goods industries worldwide. Advances in sustainable compounding techniques, bio-based plastics, and long-fiber-reinforced thermoplastics are expanding the market’s applications and performance capabilities. With Asia-Pacific leading regional demand and North America showing steady growth from infrastructure development, the market outlook remains positive despite occasional raw material cost fluctuations. As manufacturers focus on innovation and sustainability, plastic compounding will continue to play an integral role in shaping the future of lightweight, durable, and eco-friendly materials.