Overview and Market Growth

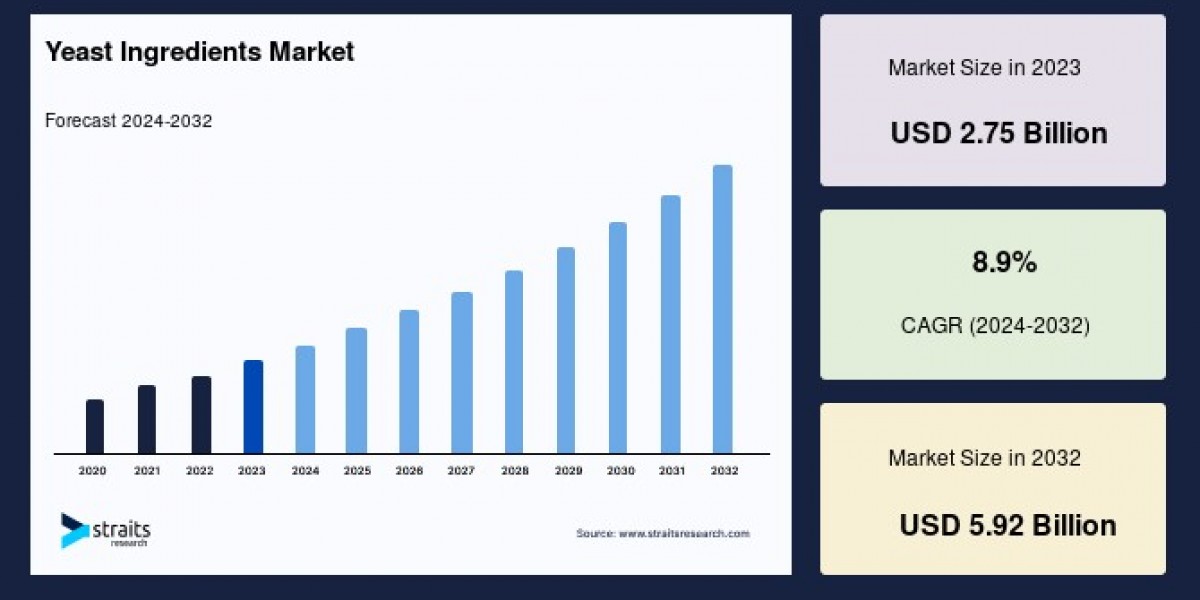

The global yeast ingredients market size was valued at USD 2.75 billion in 2023. It is estimated to reach USD 5.92 billion by 2032, growing at a CAGR of 8.90% during the forecast period (2024–2032). In recent years, consumers have increasingly become aware of the food they consume, which has led to a growing demand for clean-label ingredients owing to their health benefits.

This increasing adoption of yeast-derived ingredients is fueled by their multifaceted applications and the rising awareness of health benefits linked to clean-label food components. As consumers seek to avoid artificial additives and embrace healthier lifestyles, yeast ingredients have emerged as natural alternatives that offer flavor enhancement, nutritional enrichment, and functional benefits in a wide array of products.

Nature and Applications of Yeast Ingredients

Yeast ingredients originate from unicellular fungi, primarily derived through fermentation and extraction processes. These ingredients include yeast extracts, yeast autolysates, yeast beta-glucans, yeast derivatives, and more. Each type varies based on processing and the component composition, serving different roles across industries.

Predominantly, yeast ingredients are utilized in the food and beverage sector, where they enhance the flavor, texture, and nutritional content of items such as bakery products, dairy, meat, soups, sauces, and beverages. Their ability to act as natural flavor enhancers has made them popular substitutes for salt, sugar, and artificial additives like monosodium glutamate (MSG), thereby reducing sodium and calorie content in foods a key factor supporting health-conscious consumer trends.

Besides food applications, yeast ingredients are significantly used in animal feeds and pet foods. They improve palatability and nutritional profiles by providing essential proteins, amino acids, vitamins, and antioxidants. Furthermore, yeast inclusion in feed helps improve animal health and immunity while potentially lowering environmental impacts by mitigating greenhouse gas emissions, such as methane and ammonia from animal waste.

Beyond food and feed, yeast ingredients find use in the pharmaceutical sector for nutritional supplementation and in cosmetics and biotechnology, broadening the scope and innovation potential of the market.

Key Market Segments

The yeast ingredients market is segmented by type and end-user industries:

By Type: Yeast extracts dominate the market. These extracts are produced without additives, providing a natural, nutrient-rich component that food producers favor for flavor development. The production capacity for yeast extracts is expanding globally, driven by increasing demand in diverse food applications.

By End-user: The food and beverage sector holds the largest market share. Bakery and brewing industries notably depend on yeast ingredients for fermentation and flavoring roles. Animal feed follows as a critical end-user segment, growing in line with rising global meat and protein consumption patterns.

Regional Market Insights

Globally, Europe holds the largest share of the yeast ingredients market. This leadership is attributed to the region’s deep-rooted tradition and culture of yeast-based food production, including bakery, dairy, meat, and fermented beverages like beer and wine. European consumers show a rising preference for organic and clean-label products, further propelling market growth.

Innovative advancements are occurring, such as patented yeast strains that reduce harmful substances like acrylamide in foods, gaining regulatory approvals and boosting the clean-label movement in Europe.

North America represents another significant market, with a strong presence of key players investing in research, production expansion, and diversification into nutrition and biotechnology. The United States, in particular, is witnessing dynamic growth fueled by demand across food, feed, and pharmaceutical sectors.

The Asia-Pacific region is emerging as the fastest-growing market, driven by increasing population, urbanization, rising incomes, and heightened awareness of nutritional health. Countries such as China and India are expanding consumption of processed foods and animal protein, thereby escalating demand for yeast ingredients.

Market Drivers and Opportunities

Several factors support the growth of the global yeast ingredients market:

Growing Clean-label Demand: Consumers’ avoidance of artificial additives and preference for natural ingredients stimulate yeast ingredients’ adoption as clean-label flavoring and nutritional enhancers.

Health and Nutrition Trends: The role of yeast ingredients in improving protein intake, reducing sodium and calories, and providing bioactive compounds adds to their market appeal amid diet-conscious consumers.

Animal Feed Expansion: The rise in global animal protein consumption pushes the pet food and animal nutrition sectors, where yeast ingredients enhance feed quality, animal health, and environmental sustainability.

Innovation and New Products: Research and development are driving product innovation, such as specialized yeast extracts for plant-based foods that mimic meat flavors, expanding applications and markets.

Environmental Benefits: Yeast ingredients contribute to environmentally friendly production practices by lowering methane emissions from livestock, aligning with sustainability goals.

Challenges

Despite promising growth, the yeast ingredients market faces challenges, notably the volatility in raw material availability and costs. Yeast fermentation depends on substrates like molasses, sugarcane, corn, barley, and other grains, whose supply can fluctuate due to weather, crop yields, trade policies, and market demand dynamics. This unpredictability can impact production economics and market stability.

Strategic Market Developments

Leading companies and stakeholders in the yeast ingredients space are actively pursuing expansion and innovation strategies. Investments in manufacturing capacity, acquisitions, partnerships, and product portfolio diversification characterize the competitive landscape. For instance, expansions of yeast extract production facilities and collaborations to distribute specialized yeast ingredient brands highlight ongoing efforts to capture market opportunities.

Conclusion

The yeast ingredients market is positioned for significant growth through 2032, supported by evolving consumer preferences, health trends, animal nutrition demand, and technological advancements. Europe's established market leadership, North America’s innovation-driven expansion, and Asia-Pacific’s rapid adoption create a dynamic global market environment. Addressing supply chain challenges and continuing innovation will be key to sustaining growth and meeting the broad industry applications that yeast ingredients serve today.