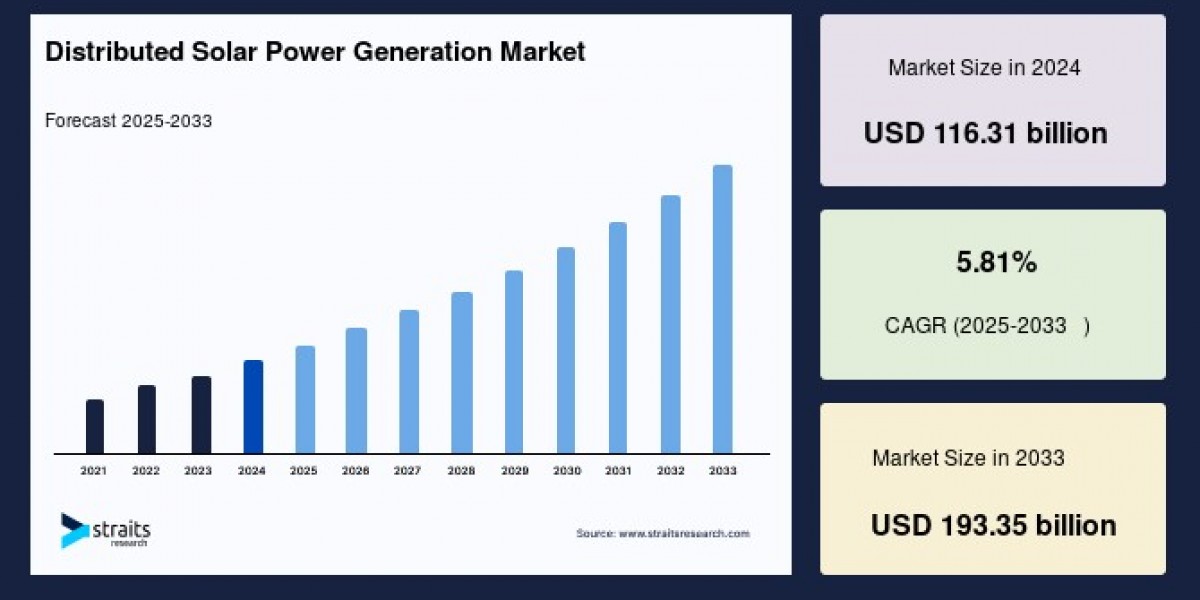

The global distributed solar power generation market size was valued at USD 116.31 billion in 2024 and is projected to reach from USD 123.06 billion in 2025 to USD 193.35 billion by 2033, growing at a CAGR of 5.81% during the forecast period (2025-2033).

Understanding Distributed Solar Power Generation

Distributed solar power generation refers to electricity produced by solar photovoltaic (PV) systems located close to the point of consumption, such as on rooftops or small commercial installations. These systems operate independently or in conjunction with the main power grid, reducing reliance on centralized power plants and improving energy efficiency. The decentralized nature helps lower transmission losses, alleviate grid congestion, and provide cleaner, more reliable power sources.

Key Growth Drivers

Several megatrends underpin the market's robust expansion:

Environmental Concerns: Rising global temperatures and growing awareness about climate change have accelerated demand for clean energy alternatives that reduce carbon emissions and dependence on fossil fuels.

Technological Advancements: Declining costs of solar PV modules, especially amorphous silicon panels, which offer a cost-effective and versatile solution, have made solar installations more accessible to businesses and homeowners.

Government Initiatives: Incentives, subsidies, and supportive policies globally encourage the adoption of solar power, including ambitious targets for grid-connected solar capacity expansion.

Energy Conservation and Cost Savings: Distributed solar systems enable consumers to generate their own electricity, cutting down electricity bills and enhancing energy security.

Market Segments and Technology Trends

Panel Types: Amorphous silicon (a-Si) PV modules currently hold the largest market share due to their low production cost and ease of installation. Mono-crystalline panels are gaining traction for their higher efficiency and durability despite higher costs. Concentrated photovoltaics (CVP) offer potential but face higher installation expenses due to cooling requirements.

Installation Types: Rooftop solar installations are the fastest-growing segment, driven primarily by residential and small commercial demand. Ground-mounted solar power systems dominate in commercial and utility sectors due to scalability and higher energy output.

System Configurations: Off-grid solar systems, essential for remote or underserved areas, require battery storage and have higher initial setup costs, while grid-connected (on-grid) systems benefit from the ability to feed surplus power back to the main grid.

Regional Insights

Asia-Pacific (APAC): The largest regional market, led by China and India, where limited grid infrastructure and increasing environmental concerns stimulate distributed solar installations. The region is expected to maintain steady growth at around a 5.5% CAGR.

North America: The fastest-growing market with a CAGR of approximately 5.9%, spurred by strong government incentives and growing corporate sustainability initiatives.

Europe: Growth is supported by ambitious renewable energy targets and robust policy frameworks in countries such as Germany, Spain, and Italy. The demand for monocrystalline panels is high due to their efficiency benefits.

Other Regions: Expansion in remote and rural areas globally presents unique opportunities for distributed solar, enabling energy access for locations with limited grid connectivity.

Challenges and Market Constraints

Despite strong growth potential, challenges remain:

High Initial Capital Costs: Setup costs, especially for off-grid systems with necessary storage, can be prohibitive, limiting adoption among middle-income consumers.

Module Efficiency and Lifespan: Amorphous silicon panels, while affordable, have lower efficiency and shorter warranties compared to crystalline alternatives, which may deter some users.

Climatic and Geographic Factors: Regions experiencing heavy rainfall, snowfall, or limited sunlight may see slow adoption rates.

Infrastructure and Technical Support: Remote deployment requires supporting infrastructure such as high-speed internet and maintenance capabilities to ensure reliability.

Future Outlook and Opportunities

The distributed solar power generation market is poised for continued expansion on the back of ongoing research, technological innovation, and strong policy momentum. Key opportunities include:

Growth in residential rooftop installations is driven by urbanization and green building trends.

Expansion in commercial and industrial sectors is seeking to reduce operational energy costs and meet sustainability goals.

Strategic development of solar infrastructure in rural and remote areas capitalizing on the rise of remote work and improved digital connectivity.

Increasing adoption of hybrid solar solutions combining distributed generation with advanced energy storage and smart grid technologies.

Leading Market Players

Industry leaders such as JinkoSolar Holding, SunPower Corp., Canadian Solar Inc., and First Solar Inc. continue to innovate and expand their presence globally, leveraging advancements in PV technology and strategic partnerships.